Before sharing your payment link with a contact, you can test the link to make sure it works as expected and experience your customer's payment journey.

Using a test mode, you can replicate the actions that take place in actual payment scenarios, without actually charging a credit card. Testing your payment links is especially important for higher payment amounts.

You can test payments made via credit card or ACH. However, you cannot test payment links for recurring payments.

Please note: you cannot test payment links for recurring payments.

To access your payment link for testing:

- In your HubSpot account, navigate to Sales > Payments.

- In the top right, click Manage payment links.

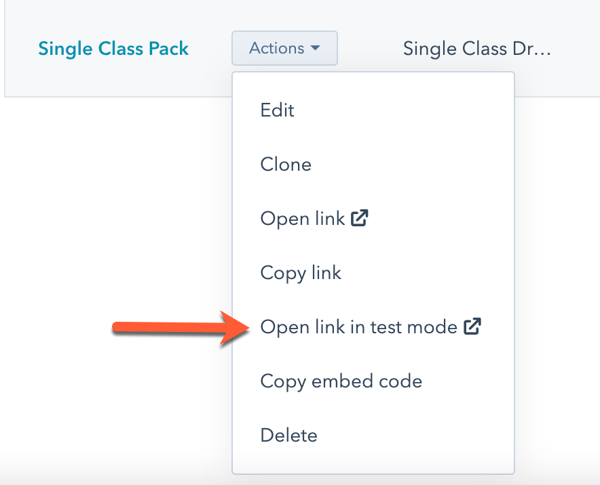

- Hover over the link and click the Actions dropdown menu, then select Open link in test mode.

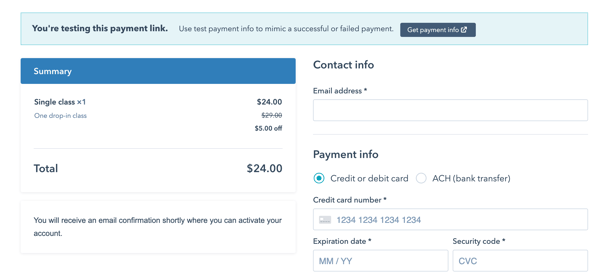

- The link will open in test mode, and a banner will appear at the top of the checkout page that indicates you are in test mode. Enter values from the tables below to complete a test purchase. You can use any address information during your test in addition to the sample credit card or ACH information.

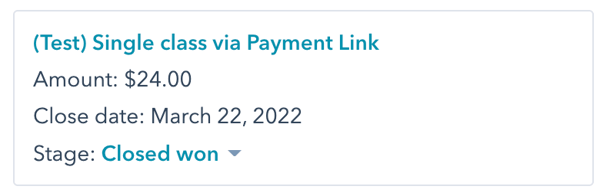

When you test your payment links, a new contact record will be created using the buyer email address entered in test mode as long as a contact record does not already exist for this email address. A deal record will also be created with (Test) included before the deal name.

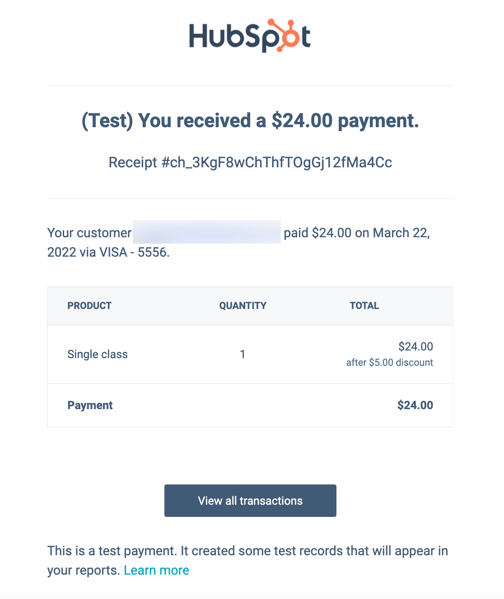

An email notification will be sent to you and to the buyer email address that you used to test the link, and you will receive a test payout email.

Test payment links for payments via credit card

When testing, you can use any address information to submit a valid test. In addition, HubSpot provides test card numbers that you can use to test the payment links. Along with the sample credit card numbers below, use following values for other fields:

- Expiration date: any valid future date

- Security code (CVC): any random number

- Name on the card: any alphabetical string

- PIN code: any 3 digits (4 digits for American Express card)

| Credit card number | Brand |

| 4242424242424242 | Visa |

| 4000056655665556 | Visa (debit) |

| 5555555555554444 | Mastercard |

| 2223003122003222 | Mastercard (2-series) |

| 5200828282828210 | Mastercard (debit) |

| 5105105105105100 | Mastercard (pre-paid) |

| 378282246310005 | American Express |

| 371449635398431 | American Express |

| 6011111111111117 | Discover |

| 6011000990139424 | Discover |

| 3056930009020004 | Diners Club |

| 36227206271667 | Diners Club (14-digit card) |

| 3566002020360505 | JCB |

| 6200000000000005 | UnionPay |

To simulate a failed payment, use the values from the table below.

| Credit card number | Error message |

| 4000000000000036 | ZIP code validation fails & payment is declined |

| 4000000000000002 | Card is declined. |

| 4000000000009995 | Payment is declined due to insufficient funds. |

| 4000000000000069 | Payment is declined due to an expired card |

| 4000000000000127 | Payment is declined due to incorrect CVC. |

Test payment links for payments via ACH

You can also test successful and failed ACH payments using the bank routing and account numbers in the table below.

| Routing number | Account number | Status description |

|

110000000 |

000123456789 | Success |

| 000111111116 | Failure upon use | |

| 000111111113 | Account closed | |

| 000222222227 | NSF/insufficient funds | |

| 000333333335 | Debit not authorized | |

| 000444444440 | Invalid currency |